vanguard emerging markets stock index fund review

Discover How Our Active Fixed Income Funds Seeks Strong Consistent Risk-Adjusted Returns. But it is exposed to emerging.

Vemix Vanguard Emerging Markets Stock Index Fund Institutional Shares Vanguard Advisors

Find a Dedicated Financial Advisor Now.

. Todays Change 0279 012. The top 10 holdings include Williams Companies Inc. Vanguards passive approach is anchored by a collection of index funds with very low expense ratios that ensure investors receive the vast majority of their returns.

VWO will begin tracking a new FTSE transition. Vanguard announced that the 50 billion Vanguard Emerging Markets Stock Index Fund including its ETF share class ticker. This mutual fund is also available as the Investors shares.

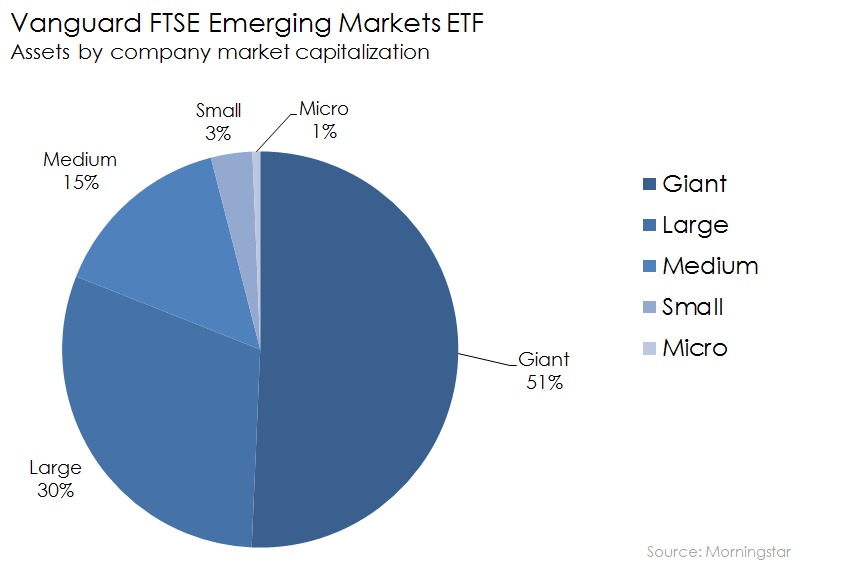

22 hours agoA high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be. The fund owns 162 stocks with a median market capitalization of around 41 billion. Ad Financial Security is Attainable.

Vanguard Emerging Markets Government Bond Index Fund NASDAQVWOB - Get Rating was the recipient of a significant decline in short interest in the month of May. So it comes down to this. But it is exposed to emerging.

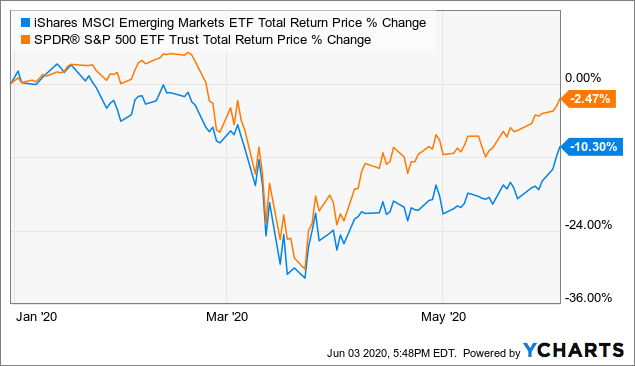

77 of retail CFD accounts. How this fund has thrived as the market tanked. Find the latest Vanguard Emerging Markets Stock Index Fund VWO stock quote history news and other vital information to help you with your stock trading and investing.

Vanguards VINEX is a good fit for investors looking for an aggressive mix of international stocks primarily in the developed markets and Pacific markets with about 10. By contrast the average. A minimum investment of 3000 is required to invest.

It also happens to be the most affordable with an. The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies. While other tools may compare funds only to the SP 500.

Vanguard Emerging Markets Stock Index has a broad portfolio and rock-bottom expense ratio that should help it perform well over the long haul. Regional ETFs invest primarily in a specific part of the world like Europe or the Pacific region. Discover Which Investments Align with Your Financial Goals.

Ad Help Build Strong Client Portfolios With Vanguard Bond Funds. Global or world ETFs provide exposure to both foreign and US. And while many emerging market funds often have high expense ratios of well over 1 percent this fund is cheap even for an index fund clocking in at 04 percent.

The investment seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located. Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF is an exchange traded fund launched and managed by The Vanguard Group Inc. It is calculated based on a Morningstar RiskAdjusted.

Before making contributions to this Investment. Vanguard FTSE Emerging Markets Index Fund ETF Shares ETF VWO. Ad Help Build Strong Client Portfolios With Vanguard Bond Funds.

Start your free trial today for. Vanguard Emerging Markets Stock Index Fund GBP Acc. Contributions to this Individual Fund Investment Option will be invested solely in the Vanguard Emerging Markets Stock Index 529 Fund.

About Vanguard FTSE Emerging Markets ETF. Ad A fund that performs well in all market environments. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes.

Review the latest Balance Sheet Statement for VANGUARD EMERGING MARKETS STOCK INDEX FUND PCQVWO - including Assets Liabilities and Equity figures. The Vanguard Emerging Markets Stock Index Fund VEMAX was launched on May 4 1994 by Vanguard. Morningstar Research Analyst Report At a low and relatively competitive fee the Vanguard Emerging Markets Stock Index Fund is an attractive option for investors seeking.

Vanguard Emerging Markets Stock Index has a broad portfolio and rock-bottom expense ratio that should help it perform well over the long haul. Discover How Our Active Fixed Income Funds Seeks Strong Consistent Risk-Adjusted Returns. Vanguard Emerging Markets Index Fund VEMAX offers a low-cost equity exposure to emerging markets.

Compare with other stocks by metrics. The Vanguard FTSE Emerging Markets ETF VWO is the most popular ETF for this space with over 87 billion in assets. That means that on average it holds a stock more than eight years.

The Vanguard index fund has just 12 turnover. Ad Long-term capital appreciation from equity securities in emerging markets. WMB Bristol-Myers Squibb Co.

Vanguard Emerging Markets Stock Index Fund Investor Shares Inv VEIEX key stats comparison.

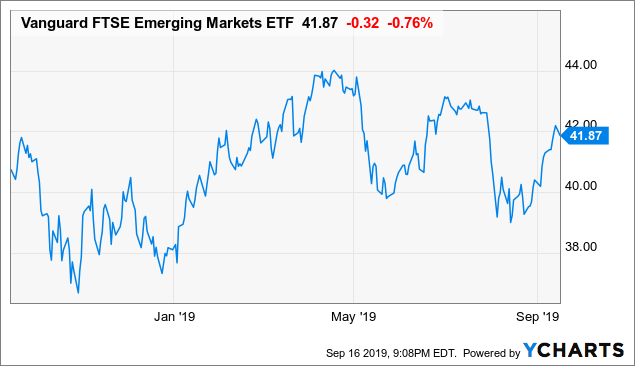

Vanguard Ftse Emerging Markets Etf A Long Term Play Nysearca Vwo Seeking Alpha

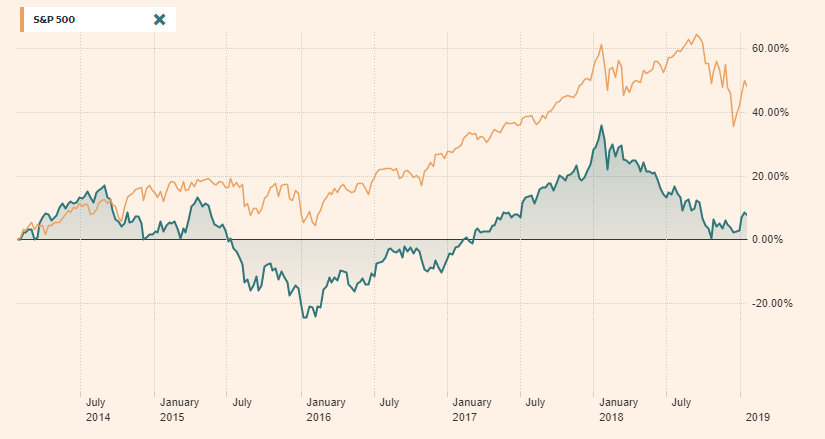

Emerging Markets If It S Not Now It S Never Seeking Alpha

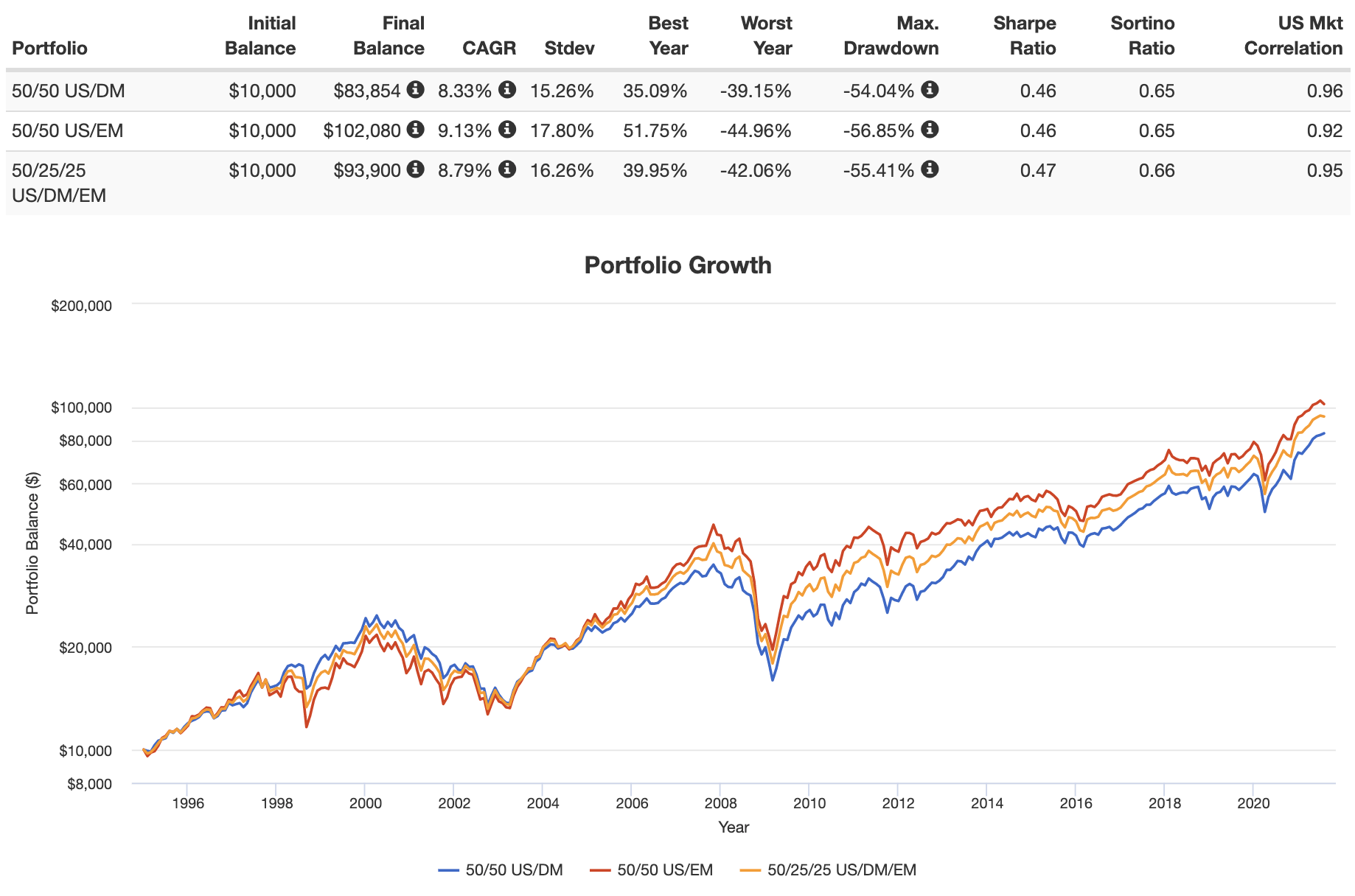

3 Reasons To Invest In The Vanguard Emerging Markets Etf Nysearca Vwo Seeking Alpha

Use Paradox Of Choice To Invest In Index Funds Investing Fund Management Investing Strategy

The 5 Best Emerging Markets Etfs 1 From Vanguard For 2022

Emerging Markets Etfs Consolidate Near Crucial Support

The 5 Best Emerging Markets Etfs 1 From Vanguard For 2022

Emerging Markets Etfs Consolidate Near Crucial Support

Vanguard Emerging Markets Stock Index Fund Gbp Ac Ie00b50mz724

Vemax See The Zacks Mutual Fund Rank For Vanguard Emerging Markets Stock Index Fund Admiral Shares Zacks Com

Vanguard Emerging Markets The Last Battlefield For Index Investing

Emerging Markets Pose Long Term Benefits Despite Short Term Risk The New York Times

Vanguard Emerging Markets Etf Pros And Cons The Motley Fool

Vanguard Emerging Market Debt Finding Value In A Time Of Pandemic

Emerging Markets Etfs Consolidate Near Crucial Support

Vanguard Emerging Markets Stock Index Fund Invest Ie0031786142

Emerging Opportunities In Emerging Market Funds Seeking Alpha

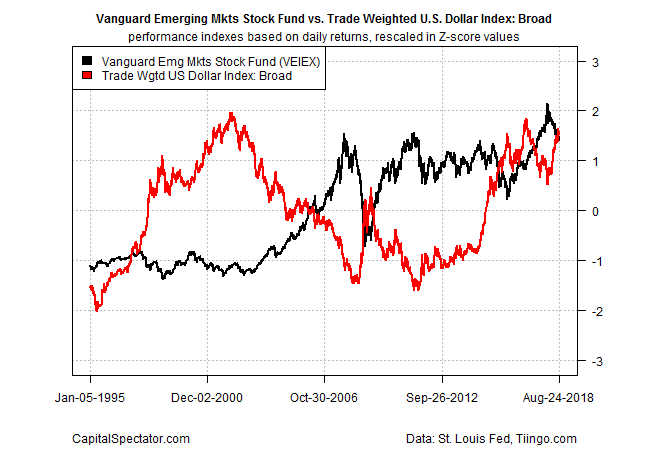

The U S Dollar Is Still A Key Factor For Emerging Market Returns Seeking Alpha